Perfect Your Inventory Setup in QuickBooks Online: Avoid Common Mistakes and Streamline Your Process

- Bandwidth Bookkeeping

- Jun 4, 2024

- 3 min read

Updated: Jan 8, 2025

Effective inventory management is crucial for businesses that sell products. QuickBooks Online offers robust features for tracking inventory, but many companies make mistakes that lead to inaccurate inventory counts and unreliable financial reports. In this post, we'll explore common inventory management mistakes and how to avoid them to ensure accurate financial tracking.

Learn how to set up your inventory correctly and maintain accurate records to prevent these common pitfalls.

Did you know that the second biggest cost for business is inventory, which can range from 25% to 35% of a business’s budget? (Forbes, Small Business Statistics of 2024).

Need help setting up your QuickBooks Online account for your business? Schedule a discovery call and speak with Tabitha Middendorf, a Certified QuickBooks ProAdvisor. |

Common Mistake: Incorrect Initial Quantities & Valuation Method

Entering incorrect starting quantities can throw off inventory tracking from the beginning.

Likewise, choosing the wrong inventory valuation method (FIFO is the default in QuickBooks Online) can impact your financial statements.

What is FIFO? FIFO stands for First In First Out. QuickBooks Online uses this method when you sell units. So it will always consider your first units purchased as the first ones sold. It will adjust your Cost of Goods Sold at the original price you paid for those first units. |

How to Avoid:

Accurate Data Entry: Ensure that initial quantities and values are entered accurately. This is important because when you purchase and record inventory in QuickBooks Online, your Inventory Asset account increases by the cost of inventory on your balance sheet. The Quantity on Hand Units also increases.

Understand Valuation Methods: Familiarize yourself with the inventory valuation methods and choose the one that aligns with your business needs.

The value of your inventory is the price you paid for it. So if you purchased a case of 10 widgets at $1.00 each, your inventory value is $10.

How QuickBooks Online Helps:

Training and Resources: Take advantage of QuickBooks Online training materials and support resources for inventory setup.

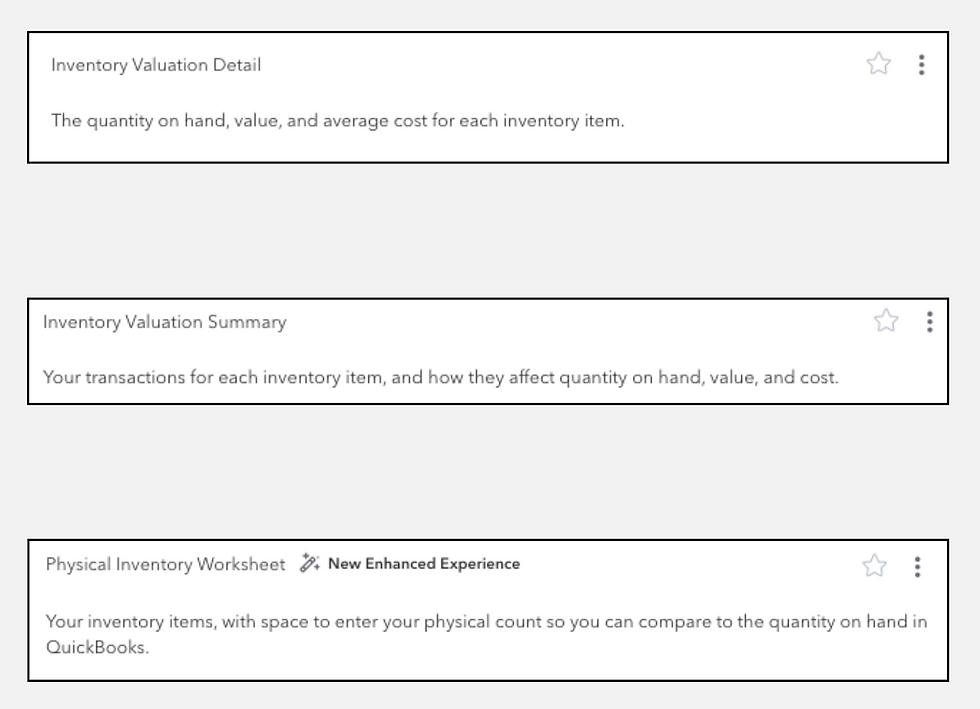

Tip: Favorite these three inventory reports in your QuickBooks Online account

Common Mistake: Not Tracking Inventory

Once inventory is set up, it's crucial to maintain accurate tracking. Ignoring inventory updates can lead to low or understocked inventory, overstocking, and financial inaccuracies.

Common Issues:

Not Recording Purchases and Sales: Failing to update inventory levels when purchasing new stock or recording sales.

Neglecting Regular Counts: Not conducting regular physical inventory counts to verify quantities.

How to Avoid:

Automate Updates: QuickBooks Online can automate inventory tracking with purchase orders and sales receipts. Make sure to use these features consistently.

Schedule Regular Counts: Conduct periodic physical counts to reconcile with your QuickBooks Online inventory records. Tip: Use the Physical Inventory Worksheet to do record and verify inventory counts.

How QuickBooks Online Helps:

Enable Inventory Tracking: QuickBooks Online can update inventory levels as you enter purchases and sales. You can also enable track quantity and price/rate and to show the product/service on sales forms. From the Gear icon, click on Company Settings, Select Sales and in the Products and Services section, turn on Track inventory quantity on hand.

Inventory Reports: Utilize inventory reports to monitor stock levels, sales, and purchase patterns.

Setup Your Inventory with Expert Help

Proper inventory management in QuickBooks Online is essential for maintaining accurate financial records and ensuring smooth business operations. By avoiding common mistakes such as incorrect initial quantities, you can optimize your cost of goods sold (COGS) calculations and prevent inventory discrepancies.

Need expert guidance on setting up your Inventory in QuickBooks Online? Schedule a 15 minute discovery call today!

Stay tuned for our next post, where we'll explore the value in having accurate customer and vendor data.

Comments